Evolution of Bitcoin Scalability

Bitcoin has had it’s fair share of market cycles and still marches on steadily upwards acting as a testament to the future of unregulated and decentralised ideal money.

As more and more users start to hold and transact in Bitcoin, we are already seeing an uptick in daily transaction volume as well as a growing demand for more utility from the dormant Bitcoin.

Whilst the beauty of Bitcoin lies in it’s slow protocol level consensus mechanism strengthening its security and decentralisation capabilities it acts as a double-edged sword when it comes to scaling. To future-proof it’s growth and sustenance, it is pertinent that key concerns like TPS, miner incentives and increased program expressivity are addressed.

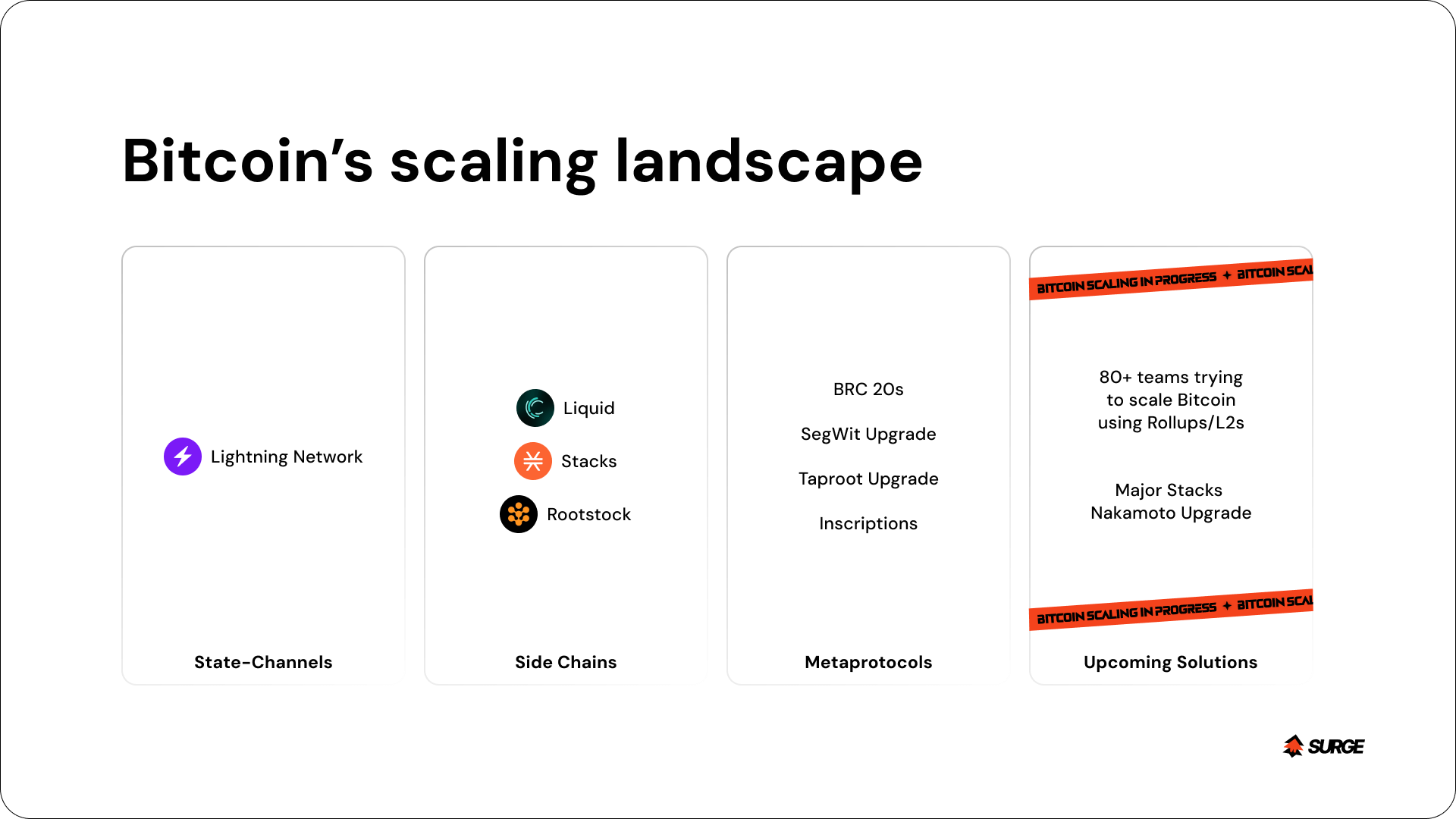

And for this very reason over the past decade there have been various approaches at scaling Bitcoin right from state-channels like the lightning network, side-chains like liquid network, rootstock and more recently metaprotocols like inscriptions and BRC-20s.

Bitcoin scaling landscape

The catch? None of these completely meet all the required criteria to be a true scaling solution, just yet.

So what makes for a true scaling solution?

- Inheriting Bitcoin security

- Trustless currency pegging between Bitcoin and L2

- Fast and cheap finality

- Increased program expressivity